IMF Debt Crisis + Money Printing + AI Job Automation = 1930s Economic Catastrophe

The sugar high of mass money-printing is concealing an emerging financial depression worse than anything we have seen in a century, driven by fatal government borrowing to pay for socialism. The labour shock of mass layoffs by emaciated small businesses employing AI means growth cannot fix it.

When things are bad, it's tempting to be alarmist when it looking into the doom. However, one's denial can equally blind one to how catastrophic the situation is. When the ship is taking on water, nobody expects to be fighting for their life in the ocean after it actually sinks.

Markets and commentators are all talking about three specific problems, but failing to take into account their ratchet effects contributing to a death spiral which is unknown in living memory.

These problems are:

- Western governments have over-taxed and over-borrowed to pay for socialist programs they cannot afford (benefits, furlough, pensions, healthcare, etc.). To fix it, they have mass-imported immigrants, hoping to increase the GDP by population under the cover of UN humanitarianism – but those immigrants are increasing the welfare bill.

- To disguise their disastrous mismanagement, the same governments have pumped mass-printed money into the economy at unprecedented levels, creating runaway inflation and driving up the cost of living, in parallel with ruinous energy policy.

- Employers looking to avoid the effects of #1 and #2 are replacing unskilled, clerical, and white collar labour by mass-adopting automated computer programs they believe can do the same as humans at a fraction of the cost.

Or if you wanted to put it more simply:

- The government can't pay its welfare bill;

- To hide it, it's printed insane amounts of extra money;

- Businesses are cutting their salary bills to cope.

When taken together, the combination of these three in concert is so staggeringly devastating, it's no wonder politicians aren't talking about it. Either they don't understand it and can't; or they do, and won't. But investors and markets who rely on predicting the future are. They're all pulling out of the debt-laden countries and putting their money into gold.

if AI eliminates middle-class jobs which generate tax revenue, governments lose the ability to service debt just as aging populations increase obligations. Money printing to bridge the gap accelerates currency debasement.

What's happening to us in this decade is worse than 2008, and worse than the 1970s. It may well be worse than the depression of the 1930s. Nobody's talking about it because we're still swimming in fake money. Woodhouse has written at length about the longest inverted yield curve in history, which is an unbeatable indicator of US recession.

What are they going to do? We all know what they are going to do, because it's what they always do. They are going to fix it for themselves, and keep it down the road so it's the next guy's problem. Because they think the economy is a set of buttons and levers they can press written about by John Maynard Keynes.

They are going to turn on the money printer and lower the interest rate, so it's easy to borrow fake money. Only that will devalue the currency and cause more inflation, which can only be tamed by increasing the interest rate. The worst socialists will tax and borrow more to cover it, driving businesses out and reducing tax revenue. Which will, in turn, take us around into the cycle again, but worse.

The policy options are all dreadful:

- Raise taxes → accelerate business failures and job losses

- Print more money → accelerate currency debasement

- Cut spending → political suicide and social unrest

- Default → systemic collapse

Previous technological disruptions took generations. AI displacement could happen within years, while demographic decline and debt service costs compound predictably each year. With flight to gold, bond market inversions, institutional positioning – these all suggest people with the most to lose are already acting as if this is inevitable.

Sovereign Debt Crisis

The International Monetary spirallingFund was established in July 1944 at the Bretton Woods Conference based on Keynes' ideas. It is a lender of last resort to countries who can't pay their bills. It has about $1 trillion on hand.

In 1976, the UK Labour government was forced to go to the IMF for a $3.9 billion bailout (the largest on record) after a worldwide energy crisis three years before (ahem, Russian gas). The Treasury's disastrous exaggerations led to the 1972 Conservative "spend for growth" budget (sound familiar?) which provoked massive inflation and a positive feedback loop of wages increasing prices, then prices increasing wages, round and round. The pound collapsed, and was followed by years of economic hell.

The U.S. holds ~17.4% quota and ~16.5% voting power, the only single-country veto over 85% supermajority decisions. UK and France are each ~4% of quota/votes (top-10 tier), with the broader G7 blospirallingc dominant.

- United States — 82.994 SDR bn (17.42%)

- Japan — 30.821 SDR bn (6.47%)

- China — 30.483 SDR bn (6.40%)

- Germany — 26.634 SDR bn (5.59%)

- France — 20.155 SDR bn (4.23%)

- United Kingdom — 20.155 SDR bn (4.23%)

- Italy — 15.070 SDR bn (3.16%)

- India — 13.114 SDR bn (2.75%)

- Russian Federation — 12.904 SDR bn (2.71%)

- Brazil — 11.042 SDR bn (2.32%)

Now let's look at how indebted each of these countries are in terms of gross debt, or how likely it is they will need a bailout if growth and infinity bamalians does not cover the deficit.

- United States —120.8% of GDP

- Japan — 240.0% of GDP

- China — 88.3% of GDP

- Germany — 63.9% of GDP

- France — 113.0% of GDP

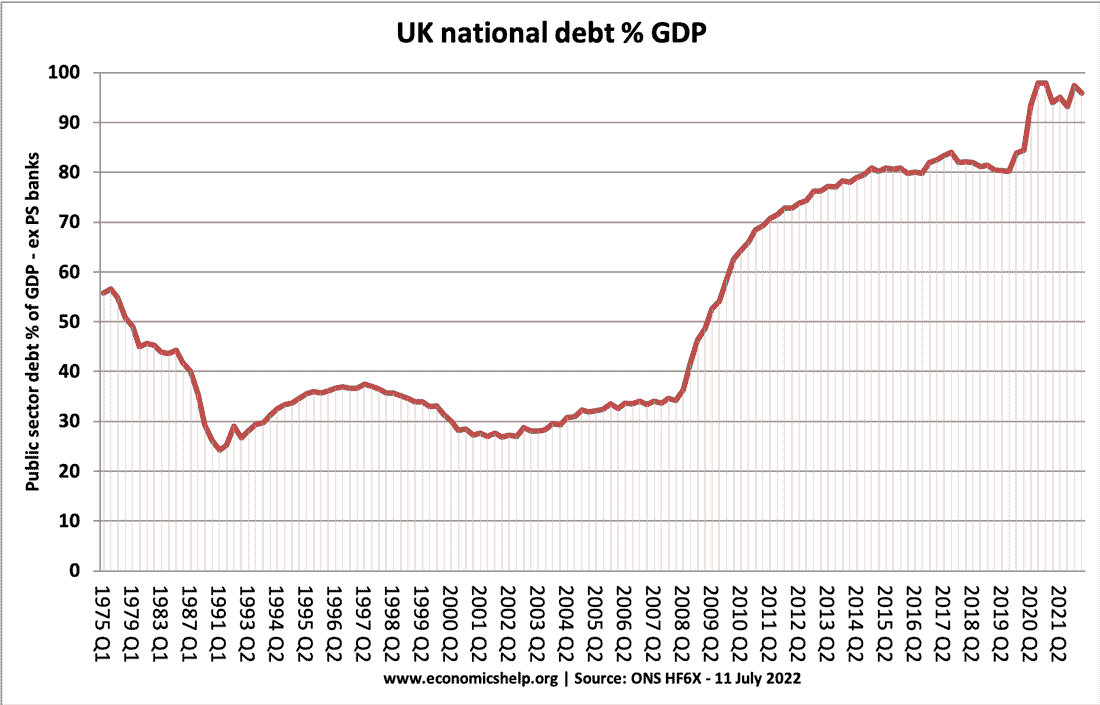

- United Kingdom — 101.2% of GDP

- Italy — 135.3% of GDP

- India — 81.2% of GDP

- Russia — 20.3% of GDP

- Brazil — 84.0% of GDP

The US, Japan, France, the UK and Italy are in very, very serious debt problems. They are in debt more than their economies can produce.

They are also the lenders of last resort.

As the Washington Post notes, the financial collapse of the UK and France is truly unprecedented, but of course, no-one mentions mass immigration:

With the British economy failing to fund the benefit costs of its aging population, the resulting borrowing spree is being financed at the highest interest rates since the 1990s. This has pushed interest costs to almost 10 percent of public spending, nearly 50 percent higher than the defense budget. Britain’s Office for Budget Responsibility warns that the current debt — just less than 100 percent of its economy — is on its way to 270 percent within five decades, which would exceed the government’s reasonable borrowing capacity.

Yet the nation remains largely in denial. A historic tax increase enacted last year was plowed into government spending rather than closing the fiscal gap and a stubborn refusal to reform spending has brought calls for another tax hike.

At least the British government is still standing. France’s fiscal chaos has brought the current government’s collapse. The narrative is familiar. Aging baby boomers and a 1.7 fertility rate mean that France’s annual deaths are likely to begin outnumbering births by 2027 — forcing all net population increases to come from immigration, which itself faces political backlash. Also like its neighbor across the channel, France’s weak productivity and stagnant workforce size has limited economic growth to 1.2 percent annually over the past decade.

Yet this socialist miscalculation will be dwarfed by America:

Yet neither France nor Britain can match the combination of debt unsustainability and denial in the United States, whose budget deficits are nearly $2 trillion and moving to $4 trillion within a decade. Within three decades, continuing current policies would propel annual deficits to 14 percent of the economy and the debt to nearly 250 percent of the economy.

Like Woodhouse, Coppen has explained this in detail: the welfare ponzi scheme was designed with a catastrophically foolish error which did not factor in unknowns like the birth control pill or mass immigration. It assumed the generations would stay the same or get larger, when they have done the opposite.

Higher borrowing costs → more government spending on interest → less fiscal room for social programs → weaker economic growth → need for more borrowing.

As the workforce shrinks and retirees grow, pension obligations balloon while fewer workers are paying in. Japan, Italy, and even the U.S. Social Security system are warning signs. Borrowing to fund benefits compounds the problem: debt service costs rise, requiring even more borrowing, eating into future budgets.

Socialist welfare programs have bankrupted the major democracies, and they can't pay the bills. Worse than that, the IMF doesn't have the money to bail them out, and the markets won't lend it to them at any reasonable rate which makes their debt serviceable.

Inflationary Money Printing

Modern Monetary Theory (MMT) is the idea governments issuing their own sovereign currency are not financially constrained in their spending because they can create money to meet obligations, with taxation serving to control inflation by removing money from the economy.

It's insane. It's stupid, insane, and so absurd a child could see it. We own the magic money tree, so we can magically make it whenever we like. Spend as much as you like because we can always print more.

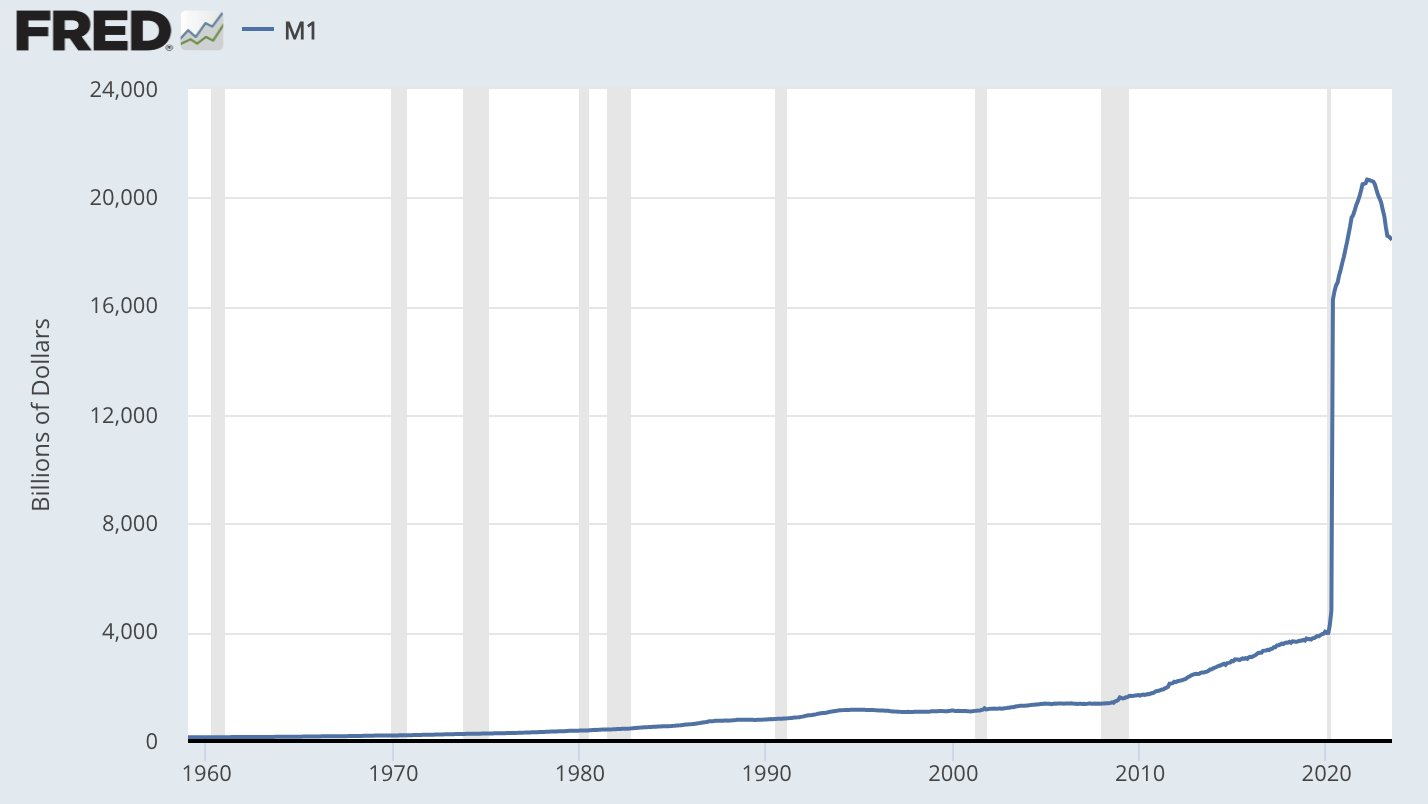

The US money printing epidemic under Biden is so insane it's scarcely possible to believe.

Since 2020, the US has printed nearly 80% of ALL US Dollars in circulation which have ever been printed since it began. At the start of 2020 she had ~$4 trillion. In 2023, there was nearly $19 trillion, a 375% jump in 3 years. The median US household has $7,300 in credit card debt but just $5,300 in savings. Inflation has made basic necessities unaffordable.

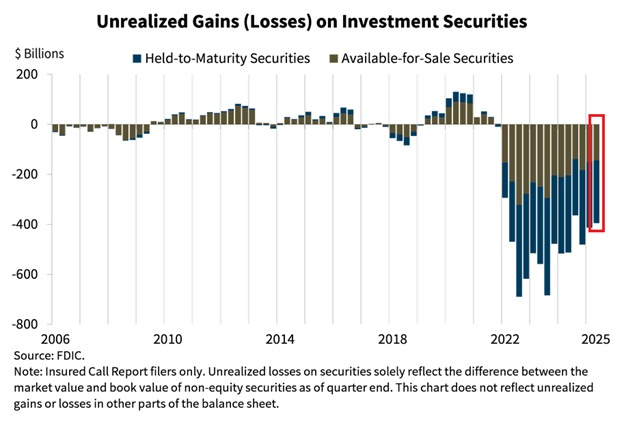

This has been reflected in the bank's losses:

Unrealised losses on investment securities for US banks reached $395.3 billion in Q2 2025: 600% higher than at the peak of the 2008 Financial Crisis. It also marks the 13th consecutive quarter of losses as interest rates remained elevated. This isn't just unfortunate, it's absolute disaster level.

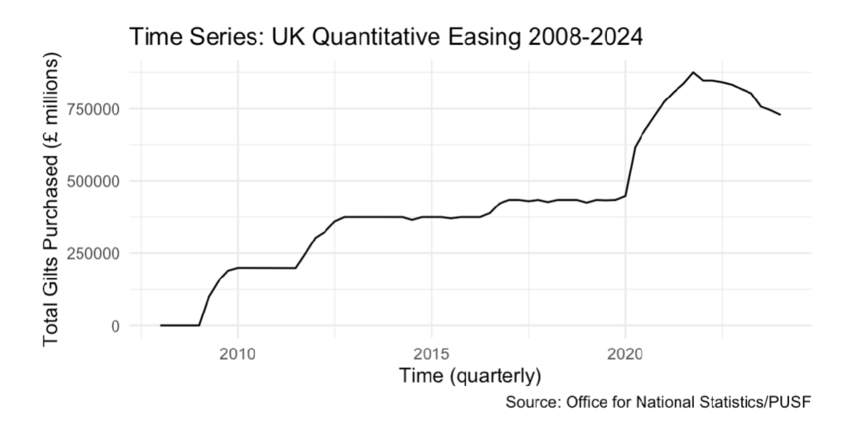

The UK, naturally, wasn't far behind on the printing machine. UK inflation peaked at 11.1% in October 2022 when Truss was being couped out so Sunak could be installed. The Bank of England (BoE) created new interest-bearing reserves and used them to buy mainly UK government bonds (gilts) via the Asset Purchase Facility (APF). This was meant to push down long-term yields, ease financial conditions, and support demand when Bank Rate was at (or near) zero.

- 2009–12: About £375bn of bonds.

- 2016: Up to ~£435bn.

- 2020–21: Jumped to ~£895bn (roughly £875bn gilts + £20bn corporates).

Since 2009, UK QE massively expanded the BoE’s balance sheet to suppress long-term rates and avert deflation, boosted GDP and CPI modestly in the early waves, stabilised markets in crises (2016, 2020, 2022), and—once rates rose—flipped from sending cash to the Treasury to drawing cash from it, while QT is now steadily shrinking those holdings.

During Covid, they printed the same amount of money as the UK government budget (what a strangely coincidental number!).

They simply printed more money to give voters a temporary sugar high which made them feel rich. Now, we're in the hangover sugar low.

AI-Driven Mass Layoffs

Labour costs make up, in many cases, over 90% of business operating costs before tax. As a small business owner, being able to cut a $200,000 worker salary by spending $2000 on an AI agent is impossible draw, especially if your margins are already small.

- Why pay a photographer $10,000 for your brochure when an AI model can do it for cents?

- Why pay $1000 for a Spanish translator when you can copy/paste your document into a webpage for a $20 subscription?

- Why pay a web designer or app coder $20,000 when AI "agents" advertise they can do it for nothing?

- Why pay a lawyer $100,000 when the "agent" technology does the same?

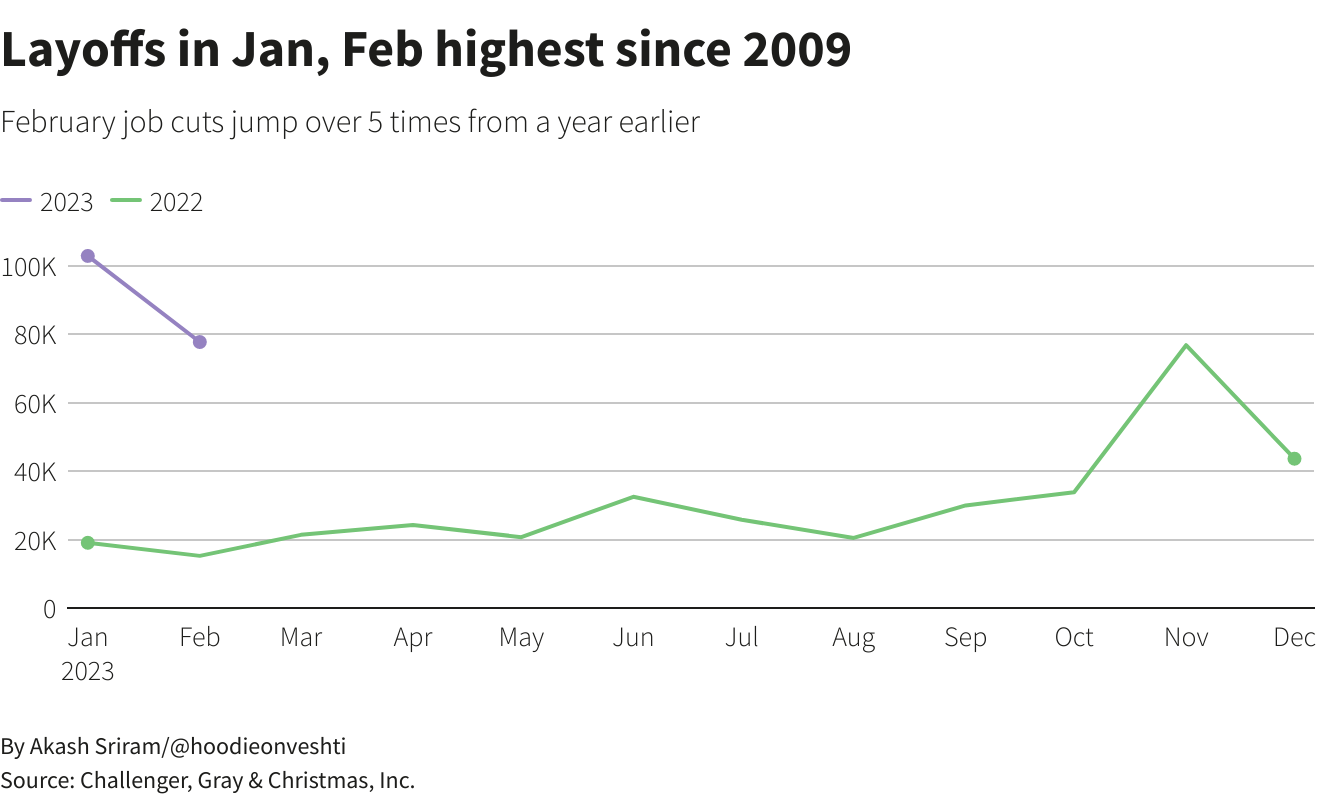

Reuters reported the amount of layoffs was the highest since the financial crisis at the beginning of the year.

The US Bureau of Labor Statistics (BLS) reported the U.S. added approximately 911,000 fewer jobs than initially estimated in the 12 months ending in March 2025. The official unemployment rate in the United States was 4.3% in August 2025. It was 10.8% for those under 25.

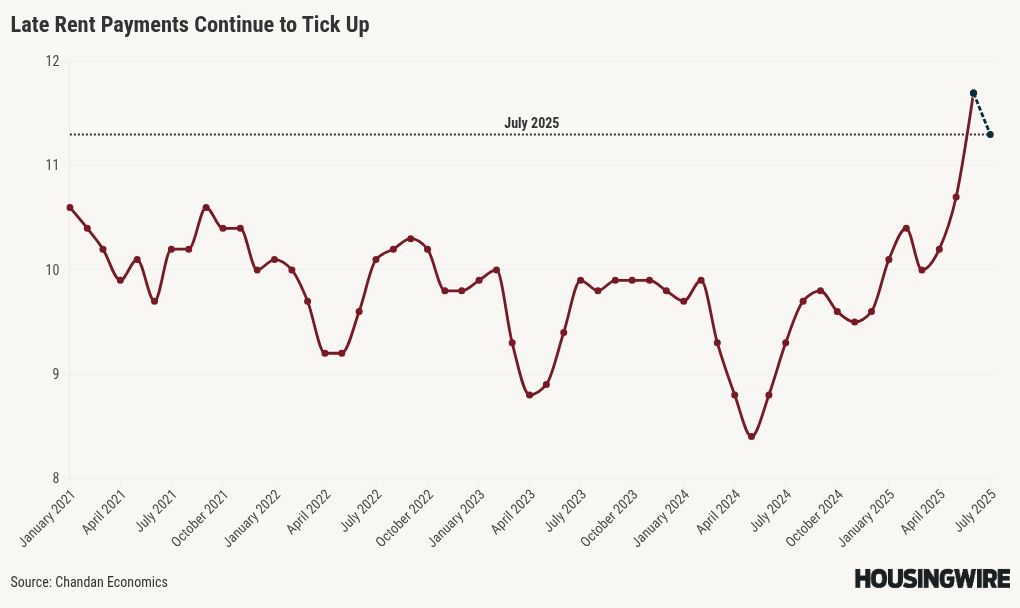

Quietly, rentals are contracting horrifically, which means mortgage owners can't pay on their investment properties:

The numbers on AI job losses are extremely grim reading even in the most varying context and dwarf the 2008 crisis:

- World Economic Forum: Employers expect 83M jobs eliminated

- IMF: ~40% of jobs worldwide will be affected by AI (advanced economies ~60% affected).

- Goldman Sachs: ~300M full-time jobs automated

- Forrester: About 2.4M U.S. jobs lost by 2030

- OECD: ~27% of jobs at high risk

These are staggering numbers. The UK workforce is 35.9 million people. The US workforce is 170.7 million people. Even 27- 40% is 9.7 - 14.4 million in the UK. It is 45 - 68 million in the US. During the Great Depression, U.S. unemployment reached a peak of roughly 25% in 1933, translating to approximately 15 million jobless Americans. During the 2008 recession, the overall U.S. unemployment rate doubled, peaking at 10% in October 2009. 9 million jobs (6%) were lost, along with 10 million homes.

If even half of the predicted losses happen at the lowest estimate (13%), it will mean 4.6 million in the UK and 22 million in the US. That's twice the horror of 2008, and (10% + 13%) = 23% or equivalent to the 1930s depression – at the lowest end.

AI hasn't "created" jobs at all. What has done so far is increase the supply of First World technology to the Third World, so employers can outsource labour to India at even cheaper prices to get better results. This is entirely understandable if 90% of your costs are salaries and the government is taxing you on the other end to pay for its welfare bill.

It's 2007 Before The Crash: What Do You Do?

Recessions and depressions are often triggered by a single event, but they can take years to be developed and fully realised. The indicators are all there, and the markets are already moving. In 2007, the smart money wasn't just about avoiding losses – it was about positioning for the massive wealth transfer which was coming.

Housing prices were still rising and unemployment was low right up until the crash.

Theoretically speaking, doing the mathematics and crystal ball-gazing if you were an investor now, staring into the abyss, you'd look at it roughly like this:

- These governments won't be able to afford their long-term debts – buy up short-term bonds at high rates.

- These countries will financially collapse and the result will be civil disorder – avoid property in distressed areas and physically move to safety.

- Taxes will go up to make up their sovereign repayments – move to another jurisdiction.

- The chaos will spread through anything speculative – bet against volatile things (retail, logistics, and white-collar service companies) and move value into precious metals and commodities.

- Your tenants won't be able to afford their rent, so you won't be able to afford your mortgage repayments – evict and sell up now.

- Your job is going to be replaced – retrain in something irreplaceable.

- Their jobs will be replaced – invest in AI infrastructure and "human-premium" sectors: luxury services, artisanal goods, personal care.

- And so on, etc.

Look at the evidence: it's exactly what's happening right now.

During the collapse phase from 2008 to 2009, homeowners lost more than seven trillion dollars in housing equity while the stock market dropped over fifty percent, decimating retirement accounts across the country. Banks faced massive writedowns and were forced into asset sales, while pension funds and insurance companies took huge losses which would affect retirees for decades.

The transfer phase from 2009 to 2012 saw private equity firms buying distressed assets for pennies on the dollar, while cash-heavy investors scooped up foreclosed properties in bulk purchases. Short sellers who had bet against the bubble made billions, and vulture funds purchased corporate debt of failing companies at steep discounts.

John Paulson made over fifteen billion dollars shorting junk mortgages, while Blackstone bought more than eighty thousand foreclosed homes and became America's largest landlord. Distressed debt funds purchased corporate bonds at twenty to thirty cents on the dollar, then collected full value when companies recovered. Warren Buffett invested five billion dollars in Goldman Sachs during the crisis, securing preferential terms which generated massive returns.

The 2008 crisis didn't actually destroy wealth, it concentrated it. The same houses, stocks, and businesses existed after 2008, but ownership had shifted dramatically from the leveraged and desperate to those with cash and patience. Assets didn't disappear, they just changed hands in what amounted to the largest forced sale in modern American history.

Crisis preparation isn't just about preservation, it's about positioning oneself to buy when everyone else is forced to sell.