The Negative Liberty Act: A Mega-Bill Molotov Cocktail

As the second bill of the Great Repeal program, NELA is a ferocious 400+ page assault on excessive taxation and regulation which provides immediate relef to the British people. It destroys obnoxious precedents and transforms the UK into the world's beacon of freedom and prosperity.

English law says unless something is illegal, it is legal. This is our ancient custom. You are free to prosper without the State intervening in what you do. Other countries may have their own – France, for example – but we, the English, have ours. Government is prescribed by God to protect the good and punish the evil. That is its function: the administration of justice. Nothing more, nothing less. Anything further is a transgression and an overreach of its natural place.

Negative rights and liberty are freedom from being interfered with. The continental alternative, the notion of "positive" rights where one must ask the state for permission under the law, are an aberration. They are alien to us. Our rights and liberty are given by God, whom the Monarch serves; they are not issued by a republic on a piece of paper. They precede humanity itself or human government and stand independent of us.

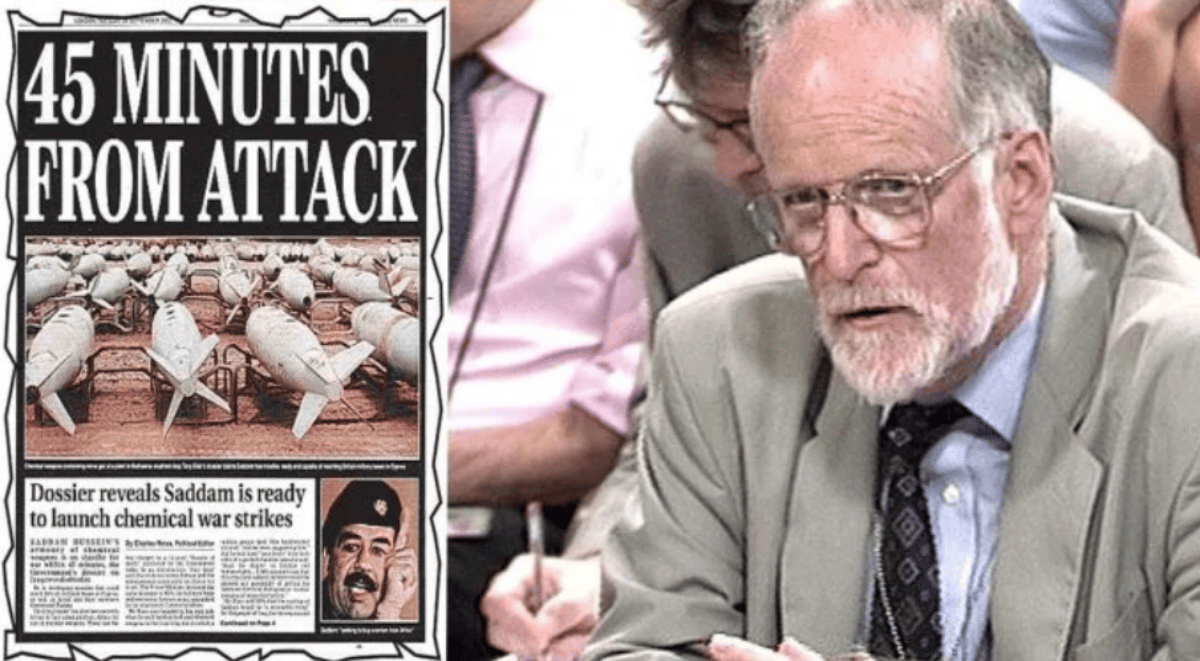

The last 100 years have seen the United Kingdom fall in to the disrepair of a "positive liberty" state because of two disastrous world wars. Blair's technocratic managerialism entrenched this doctrine. It must be entirely excised, like a rotten set of teeth.

In that spirit, we present the correction to such an era: the Negative Liberty Act.

Read the draft Negative Liberty Act. in full here (408 pages):

What Is "Negative" Liberty?

Negative liberty is the freedom from interference by others, particularly by the State. As the philosopher Isaiah Berlin defined it, negative liberty answers the question "What is the area within which the subject is or should be left to do or be what he is able to do or be, without interference by other persons?"

Individuals are born naturally free and may act as they choose unless their actions harm others. The State's sole legitimate function is to prevent such harms, not to prescribe or permit particular behaviours. Laws restrict what you must not do rather than grant permission for what you may do.

The most authoritative and widely cited definition comes from Berlin's 1958 lecture "Two Concepts of Liberty":

I am normally said to be free to the degree to which no man or body of men interferes with my activity. Political liberty in this sense is simply the area within which a man can act unobstructed by others.

This concept has deep roots in English common law and constitutional tradition. The Magna Carta of 1215 established even the King was bound by law and could not arbitrarily interfere with subjects' liberties. The English Bill of Rights 1689 further enshrined protections from State interference, guaranteeing freedoms that existed prior to and independent of statute.

These documents did not grant new rights but rather recognised and protected ancient liberties Englishmen possessed by birthright. Thinkers such as John Locke articulated this philosophy, arguing natural rights to life, liberty, and property preceded government and legitimate authority exist only to protect these pre-existing freedoms.

Negative liberty is responsible for the two mightiest empires in human history, the transition of which was so seamless no-one even noticed: the British Empire (Pax Britannica) and its dominion of the modern world (1815-1940), and the American Empire (Pax Americana) with its unmatched power (1945-now).

It is also the reason China will never dominate in the same way, despite its growing power, because freedom and prosperity are intrinsically linked. Only an empire which processes dissent can survive.

Under negative liberty you may ride a bicycle anywhere unless law specifically prohibits harming others whilst doing so. Under positive liberty you may ride a bicycle only where, when, and how the State permits through licensing and regulation. The former places the burden on government to justify restrictions; the latter places the burden on citizens to obtain permission. English constitutional tradition has always historically favoured the negative liberty approach, viewing expansive State interference as tyranny.

This grotesque violation of ancient English custom must be reversed, so England may be restored. The Negative Liberty Act is an intellectually-violent 400+ page assault on everything and anything to do with alien "positive" doctrine we have been infected with since WWI. We are the English; England is a free country. It will be so again, for ten thousand years – and another ten thousand afterwards.

The Negative Liberty Act: A Comprehensive Guide

Introduction

The Negative Liberty Act represents the most extensive constitutional and legislative reform in British parliamentary history. Spanning 260 sections organised into sixteen Parts and supported by eleven Schedules, this legislation fundamentally restructures the relationship between citizen and state, reasserts parliamentary sovereignty, abolishes wide swathes of regulatory frameworks, and redefines the constitutional settlement across every major area of governance.

The Act proceeds from the philosophical foundation of negative liberty—the principle whereby individual behaviours remain lawful unless Parliament has explicitly legislated against them. Rights are conceived not as permissions granted by the state through positive law, but as natural freedoms existing prior to government, protected from interference save where statute specifically prohibits conduct. This framework reverses the modern regulatory presumption whereby activities require prior authorisation, returning instead to the common law tradition whereby freedom is the default and restriction the exception.

The legislation addresses sovereignty and constitutional fundamentals, judicial structure and powers, executive authority and civil service organisation, parliamentary composition and accountability, criminal law and policing, immigration and border control, taxation and public finance, commerce and employment regulation, land use and development, energy policy, public services, surveillance and civil liberties, foreign relations, civil society, monetary policy, and final administrative provisions. Each Part contains provisions of constitutional significance, many reversing legislation enacted over the past century.

PART I – SOVEREIGNTY & CONSTITUTIONAL FUNDAMENTALS

Section 1 establishes what the Rule of Law actually means in plain terms. The law consists only of Acts of Parliament and common law decisions from courts—nothing else.

Section 2 declares Parliamentary supremacy absolute and unlimited. Parliament can make or unmake any law whatsoever, and no person or body may override legislation. Courts must interpret Acts according to their plain meaning, giving effect to Parliament's intention as expressed in the text.

Section 3 introduces impeachment for the monarch. The Commons can impeach by two-thirds vote, with trial before the Lords requiring two-thirds for conviction. Upon conviction, the throne passes to the heir.

Section 4 confirms the Crown's treaty-making powers remain beyond judicial review or parliamentary approval requirements, unless statute explicitly requires approval. The Miller case concerning Brexit is overruled.

Section 5 prohibits courts from reviewing decisions based on incompatibility with international treaties. Compliance with international obligations is exclusively a matter for Parliament and the executive.

Section 6 abolishes the doctrine whereby customary international law forms part of domestic law. No rule of customary international law has effect unless Parliament explicitly incorporates it by statute.

Section 7 removes any requirement in government codes for ministers or civil servants to comply with international law. Ministers and civil servants are bound only by domestic United Kingdom law.

Section 8 prohibits Parliament from passing Bills of Attainder—laws declaring named persons guilty or imposing punishment without judicial proceedings.

Section 9 protects against expropriation. Property may only be taken as punishment following conviction, for public purposes upon payment of market-value compensation, or through court judgment.

Section 10 overrules the Supreme Court's 2019 decision in Miller No. 2 concerning prorogation of Parliament. The prorogation of Parliament is declared a prerogative act on ministerial advice, and no court has jurisdiction to review the decision to prorogue, its duration, reasons, or effects.

PART II – THE JUDICIARY

Section 14 abolishes the Supreme Court and establishes the Final Appeal Court with twelve Lords Justice of Final Appeal.

Section 15 restores the Lord Chancellor as head of the judiciary for England and Wales, with supreme responsibility for judicial appointments, discipline, administration, salaries, and assignment of judges.

Section 16 abolishes the Judicial Appointments Commission. The Lord Chancellor gains unfettered power to select and appoint all judges, exercising this personally without consultation requirements.

Section 17 requires complete transparency in judicial nominations. Candidates for High Court or above must be publicly identified sixty days before appointment, with full disclosure of background, judicial philosophy, affiliations, financial interests, and family connections.

Section 18 amends removal procedures for High Court and appellate judges. The Lord Chancellor may recommend removal for persistent substitution of policy preferences for statutory text, creating obligations not found in law, refusing to apply valid Acts based on alleged incompatibility with non-incorporated international instruments, extending court jurisdiction beyond that conferred by Parliament, or judicial activism as defined.

Section 19 abolishes the Judicial Conduct Investigations Office. Complaints are investigated by case-by-case tribunals appointed by the Lord Chancellor. Tribunals may recommend reprimand, suspension, salary reduction, transfer, or removal.

Section 20 strictly limits judicial review grounds to procedural fraud only.

Section 21 requires full effect for ouster clauses. Where an Act provides a decision shall not be questioned in any court, that provision must be given plain meaning.

PART III – THE EXECUTIVE

Section 22 establishes the Department of the Prime Minister, assuming all Cabinet Office functions including coordination and supervision of government, civil service management, national security coordination, propriety and ethics, constitutional matters, government communications, and contingency planning.

Section 23 abolishes the Cabinet Office within six months. All property, rights, liabilities, and staff transfer to the Department of the Prime Minister.

Section 24 revives Parliamentary impeachment of ministers. The Commons may impeach the Prime Minister or any minister for high treason, bribery or corruption, wilful violation of Acts, gross dereliction of duty, conspiring to subvert the constitution, or abuse of position for personal gain.

Section 25 repeals Part 1 of the Constitutional Reform and Governance Act 2010, removing the statutory basis for civil service management.

Section 26 requires complete obedience and loyalty from civil servants to their minister, overriding any other code except the duty not to commit criminal offences.

Section 27 permits ministers to dismiss any civil servant at Deputy Director level or above by giving three months' notice (or less at the minister's discretion).

Section 28 abolishes the Civil Service Commission. Ministers gain complete autonomy to establish recruitment procedures.

PART IV – PARLIAMENT

Section 29 restricts public office eligibility to those born in the United Kingdom, Crown Dependencies, or British Overseas Territories, ordinarily resident fifteen years, and who have sworn a prescribed oath of allegiance before a Justice of the Peace.

Section 30 abolishes the Electoral Commission. Political parties may form and operate without registration, approval, or permission, subject only to criminal law.

Section 31 removes all limits on campaign expenditure. Anyone may spend unlimited amounts supporting or opposing candidates or parties, provided funds are lawfully obtained.

Section 32 requires Parliamentary candidates to pass the Parliamentary Qualification Examination testing knowledge of British history, constitutional law, institutional understanding,

Section 33 abolishes postal voting except for armed forces overseas, Crown servants posted overseas, persons physically unable to attend polling stations, and detained persons not convicted.

Section 34 prohibits public office holders from membership of organisations seeking to influence or usurp British domestic policy on a supranational basis.

Section 35 requires public office holders to declare membership of Masonic lodges, private clubs, professional associations with covert operational doctrines, religious organisations, charitable trusteeships, and any organisation potentially creating conflicts of interest.

Section 36 establishes recall of government. A petition signed by three million registered electors triggers a debate on a no-confidence motion. If carried by simple majority, the Prime Minister must resign and advise dissolution within seven days or seek a confidence vote.

Section 37 limits Parliamentary immunity under the Bill of Rights 1689 to words spoken in Parliamentary proceedings. MPs may be privately prosecuted for any criminal or civil offence committed outside the Chamber or committees.

Section 38 permits either House to impeach and remove its own members for conviction of imprisonable offences, corruption, persistent non-attendance, conduct bringing Parliament into disrepute, or breach of oath.=

Section 39 automatically removes MPs whose attendance at divisions falls below forty per cent in any session without reasonable excuse.

Section 40 requires every MP to maintain a constituency office open three days weekly when the House sits and five days during recess, staffed by at least one full-time employee, with location and hours advertised.

Section 41 makes failure to answer Parliamentary Questions contempt of Parliament. Ministers providing deliberately misleading or evasive answers commit contempt.

Section 42 prohibits MPs from using Parliamentary time, resources, or facilities to campaign for foreign states' interests, changes to foreign law or policy, infrastructure construction abroad, or matters not directly concerning the United Kingdom.

Section 43 permits His Majesty by Order in Council to revoke peerages, knighthoods, or honours where the holder has been convicted of an offence punishable by over twelve months' imprisonment, brought the honours system into disrepute, obtained the honour by misrepresentation, committed treason or sedition, gravely injured public sensibilities, or acted contrary to United Kingdom interests.

Section 44 permits the Commons to impeach any member of the Lords for high crimes and misdemeanours, persistent non-attendance, abuse of Parliamentary privilege, conduct incompatible with membership, or acting as a foreign agent.

Section 45 permits the Commons to impeach any public office holder including senior civil servants, judges, chief constables, police commissioners, heads of non-departmental bodies, Bank of England governors and directors, revenue commissioners, and intelligence service directors.

Section 46 establishes a constitutional debt ceiling at sixty per cent of GDP. Exceeding this prohibits further borrowing except for refinancing existing debt, requires an emergency budget within fourteen days to reduce debt below the ceiling within three years, and prohibits public expenditure increases until debt falls below fifty-five per cent.

Section 47 prohibits budget deficits except during declared wars, declared states of emergency, or where both Houses approve by two-thirds majority for one year only.

Section 48 prohibits monetary financing and quantitative easing. The Bank of England cannot purchase government securities directly from the Treasury, create money for government expenditure, engage in quantitative easing, or provide monetary financing.

Section 49 limits welfare expenditure to twenty-five per cent of total government expenditure. Welfare includes all social security benefits, tax credits, housing benefit, council tax benefit, child benefit, working tax credit, and universal credit.

PART V – LAW & ORDER

Section 50 repeals all speech offences including section 127 Communications Act 2003, the Malicious Communications Act 1988, the Public Order Act, Racial and Religious Hatred Act 2006, hatred on grounds of sexual orientation, and any provision creating offences for "offence,"

Section 51 repeals the Public Order Acts 1986 and 2023.

Section 52 abolishes anti-social behaviour orders, anti-social behaviour injunctions, criminal behaviour orders, community protection notices, public spaces protection orders, dispersal orders, parenting orders, acceptable behaviour contracts, and any civil order criminalising conduct not otherwise an offence or restricting liberty without conviction.

Section 53 abolishes non-crime hate incidents. No police, authority, or body may record, log, maintain, share, or retain information concerning incidents not constituting suspected or actual criminal offences.

Section 54 ensures no person may be convicted unless a prosecution proves beyond reasonable doubt each element by objective facts, the offence is defined with sufficient clarity, and it does not depend on subjective perception, feeling, or interpretation.

Section 55 repeals section 7 of the Terrorism Act 2000. No British citizen may be required to answer questions, provide information, or produce documents where they would be entitled to refuse if questioned as a suspect in a police station.

Section 56 prohibits adoption or application of definitions, policies, or codes designating conduct as extremism, pseudoscientific categorisations as phobia, or subjective opinions of hatred where not founded upon criminal conduct.

Section 57 repeals the Equality Act 2010 in its entirety. Also repealed are all related equality legislation and anything to do with it.

Section 58 repeals the Online Safety Act 2023 in its entirety. Ofcom ceases online safety functions; all codes, guidance, and enforcement decisions are void.

Section 59 prohibits superinjunctions preventing publication of information about the injunction's existence.

Section 60 allows anyone with a legal right to a public duty's performance to apply for a writ of mandamus compelling that performance. The writ issues as of right where the duty is clear and owed to the applicant.

Section 60A clarifies mandamus cannot review decision merits or compatibility with international law, only compel clear statutory duties be performed.

Section 61 lets anyone convicted under repealed provisions apply for complete expungement. Upon approval, all records are destroyed and the conviction treated as never having occurred.

Section 62 abolishes mandatory minimum sentences, giving courts full discretion based on offence seriousness and circumstances.

Section 63 legalises personal defence devices like stun guns and pepper spray for those over sixteen without recent violence convictions, provided devices cannot cause permanent injury.

Section 64 confirms Parliament is sovereign, the Parliament Acts are valid, and courts cannot question any Act's validity on any ground whatsoever.

Section 65 restricts police stop and search to specific articulable facts suggesting criminal connection, not location or appearance. Arrests without warrant become limited to indictable offences or preventing physical injury. Confessions obtained through oppression or unreliable circumstances become inadmissible unless prosecution proves otherwise beyond reasonable doubt.

Section 66 abolishes Police and Crime Commissioners. Functions transfer to chief constables for operations and the Secretary of State for strategy and resources.

Section 67 removes educational qualification requirements for police officers. Forces cannot require degrees or academic qualifications but may test literacy, numeracy, fitness, and aptitude.

Section 68 dissolves the College of Policing. Its standard-setting and training functions transfer to the Secretary of State, who may establish a new body without power to impose requirements on chief constables.

Section 69 prohibits police officers from political party membership, public political expressions, demonstrations, or wearing political symbols including diversity campaigns. Breach results in dismissal and up to twelve months' imprisonment.

Section 70 codifies Peelian Principles that police exist to prevent crime and disorder, depend on public approval, secure willing cooperation, use force only when necessary and minimally, serve the law impartially, maintain that police are the public, refrain from usurping judicial powers, and measure efficiency by absence of crime rather than visible enforcement.

Section 71 requires increasing prison capacity to at least two hundred thousand places within five years.

Section 72 permits foreign national offenders serve sentences abroad without their consent or the foreign government's consent.

Section 73 makes all foreign nationals convicted of any offence liable to deportation unless sentenced only to a fine for a summary offence or exceptional circumstances exist.

PART VI – THE BORDER

Section 74 prohibits granting leave to enter or remain for five years except for spouses or civil partners of British citizens resident five years, children under eighteen of British citizens resident two years, transit for forty-eight hours, court attendance, or overwhelming compassion in wholly exceptional circumstances limited to urgent life-saving medical treatment at no public cost.

Section 75 requires conditions and restrictions giving effect to the moratorium, with immigration officers refusing entry to anyone without valid leave.

Section 76 allows phased relaxation after five years for persons with skills in short supply, those establishing businesses employing fifty British citizens, investors of ten million pounds minimum, and qualifying spouses and children.

Section 77 denies all social security benefits, social services support, homelessness assistance, education grants, NHS treatment except emergencies and infectious diseases, social housing allocation, and public funds to foreign nationals.

Section 78 restricts asylum to those with probable cause of persecution by the state or by actors the state cannot suppress, where systematic extermination or genocide exists, arriving directly from the persecution territory with identity documents presented immediately upon arrival. Asylum is temporary for one year maximum without extension or settlement rights. Applications are refused if the person transited safe third countries, lacks identity documents, destroyed documents, failed to claim immediately upon arrival, has criminal convictions, or poses security dangers.

Section 79 directs maritime interception of vessels believed to carry persons intending illegal entry.

Section 80 suspends obligations under the 1951 Geneva Refugee Convention and 1967 Protocol pending renegotiation.

Section 81 requires immediate removal of all persons entering without leave, remaining beyond leave periods, or obtaining leave by deception. Detention occurs upon identification, seven days' notice precedes removal, and removal occurs within thirty days

Section 82 reduces deportation notice periods to seven days. Appeals must be filed within fourteen days and determined within twenty-eight days, with extensions only for wholly exceptional justice requirements. Removal occurs within seven days of appeal dismissal.

Section 83 criminalises facilitating entry, travel arrangement, or organisation for individuals without valid leave. Facilitation includes transport, accommodation, financial assistance, advice, or acting as intermediary.

Section 84 requires official documents to offer English, Scottish, Welsh, or Northern Irish identity options. Passports state nationality as British (English), British (Scottish), British (Welsh), or British (Northern Irish).

PART VII – THE EXCHEQUER

Section 85 entitles individuals under twenty-five to deduct ninety per cent of total income before calculating income tax liability.

Section 86 establishes a flat ten per cent income tax rate, repealing all differential rates.

Section 87 provides a fifty thousand pound personal allowance for every individual, never reduced regardless of income, age, or circumstance.

Section 88 makes PAYE voluntary. Individuals may elect to file their own returns and pay directly.

Section 89 sets corporation tax at a flat five per cent rate.

Section 90 allows companies to offset corporation tax by verified costs of public beautification, cultural enrichment, horticultural development, or architectural enhancement accessible free to the public year-round.

Section 91 sets the annual capital gains tax exempt amount at one million pounds, with unused amounts carried forward indefinitely.

Section 92 charges capital gains tax at fifteen per cent on gains exceeding all available exempt amounts.

Section 93 exempts assets held over two years from capital gains tax entirely, including land, shares, cryptocurrency, goodwill, debts, options, foreign currency, chattels, and all property.

Section 94 sets the dividend allowance at one million pounds annually, with unused amounts carried forward indefinitely.

Section 95 charges dividend income at fifteen per cent on amounts exceeding all available allowances.

Section 96 exempts shares, securities, and cryptocurrency held over two years from dividend income tax and capital gains tax. Spouses' holding periods combine.

Section 97 allows individuals under forty to opt out of National Insurance contributions for up to fifteen years.

Section 98 abolishes employee National Insurance contributions and replaces them with a seven and a half per cent employer levy on total gross earnings paid monthly, with no exemptions, thresholds, allowances, or upper limits.

Section 99 abolishes Value Added Tax entirely from the first day of the third month post-Royal Assent. All VAT registrations, assessments, and charges cease.

Section 100 permits parish councils to impose sales taxes up to fifteen per cent on retail sales within their areas by simple majority resolution. Retailers must collect, record, and remit monthly.

Section 101 prohibits wealth taxes—any tax calculated by reference to asset value or net worth.

Section 102 requires HMRC to establish a continuous tax record system whereby individuals and companies may maintain real-time electronic records of income, expenditure, gains, losses, and liabilities.

Section 103 requires the Treasury to consolidate all taxation enactments into a single Tax Code Act not exceeding fifty pages within three years, with schedules containing only lists, tables, and forms.

Section 104 permits self-employed persons with income below fifty thousand pounds to elect a five per cent micro-tax with no expense deductions, losses, allowances, reliefs, records, or returns required.

Section 105 taxes United Kingdom residents on foreign income and gains only when remitted to the United Kingdom.

Section 106 permits full expensing of all plant and machinery expenditure in the year incurred, replacing writing-down allowances and pools.

Section 107 allows individuals or companies to deduct fifty per cent of equity investments in qualifying entrepreneurial ventures from their tax liability.

Section 108 exempts company profits from corporation tax if retained in the company and not distributed within twelve months.

Section 109 exempts tips and gratuities received by employees from customers from income tax and National Insurance contributions.

PART VIII — COMMERCE & EMPLOYMENT

Section 110 sunsets all regulations made after commencement on the tenth anniversary of their making unless Parliament expressly renews them by primary legislation for further periods up to ten years.

Section 111 revokes all retained EU law.

Section 112 abolishes parallel import restrictions deriving from European Court jurisprudence.

Section 113 requires a review of data protection legislation within six months regarding costs to SMEs, EU law derivation, penalty proportionality, innovation impediments, and alternative approaches

Section 114 abolishes all licences, permits, approvals, and registrations specified in Schedule B.

Section 115 repeals health and safety enforcement provisions under the Health and Safety at Work Act 1974 and dissolves the Health and Safety Executive.

Section 116 revokes UK REACH chemical regulation requirements. No registration, authorisation, restriction compliance, safety data sheets, or chemical safety reports are required from commencement.

Section 117 repeals the Planning Act 2008 nationally significant infrastructure provisions. No development consent is required for infrastructure projects regardless of scale. Environmental Impact Assessment regulations are revoked.

Section 118 abolishes electricity and gas generation, supply, transmission, and distribution licences; environmental permits for energy installations; and consents for constructing or operating generating stations. Ofgem is dissolved except for preserved functions transferred to the Secretary of State. Anyone may generate, transmit, distribute, or supply electricity or gas without licences from commencement.

Section 119 revokes Financial Conduct Authority listing rules except those relating to fraud, market manipulation, insider dealing prevention, misleading conduct prevention, and technical trading venue requirements.

Section 120 repeals directors' duties regarding community and environmental impact, non-financial information statements, energy and carbon reports, and reporting on environmental matters, employees, social matters, human rights, anti-corruption, and diversity beyond what gives a true and fair financial view.

Section 121 prohibits public funding for environmental litigation including bringing or supporting challenges on environmental grounds, enforcement litigation, research or campaigning related to litigation, or legal advice and representation.

Section 122 requires review of pharmaceutical approval requirements within three months considering approval times versus other jurisdictions, costs, patient access delays, mutual recognition opportunities, and proportionality of requirements.

Section 123 exempts small and medium-sized enterprises from unfair dismissal and redundancy payment provisions.

Section 124 repeals IR35 intermediaries legislation for both public and private sectors.

Section 125 requires proposals within six months for reforming unfair dismissal law and tribunal procedures to reduce employer costs and hiring deterrents whilst maintaining protections against arbitrary or discriminatory dismissal and ensuring expeditious proportionate tribunal determinations.

Section 126 validates at-will employment contracts permitting either employer or employee termination anytime with or without cause, subject only to agreed notice periods, notwithstanding the Employment Rights Act 1996 or other unfair dismissal legislation.

Section 127 repeals the National Minimum Wage Act 1998 and regulations.

Section 128 confirms private companies limited by shares may have single members holding all shares who may act as sole director, company secretary, and exercise all general meeting powers.

Section 129 permits incorporating companies using distributed ledger technology, smart contracts, or programmable systems for governance.

Section 130 permits English law business contracts without United Kingdom presence, establishing validity where no party resides, is domiciled, or incorporated domestically. Courts retain jurisdiction through contractual agreement or party consent.

Section 131 authorises banks to offer cryptoasset custody services without requiring separate regulatory approval.

Section 132 removes restrictions on foreign currency deposits and accounts. Banks may accept deposits in any currency and offer simultaneous multi-currency balances with conversion facilities.

Section 133 facilitates connections between United Kingdom banks and overseas branches in Crown Dependencies and British Overseas Territories.

Section 134 recognises qualifying cryptoassets as private money usable for exchange, storage, and accounting. Banks cannot refuse services solely because customers engage in cryptoasset transactions.

Section 135 amends the Bribery Act 2010, creating defences for conduct lawful abroad where adequate prevention procedures exist and for nominal facilitation payments securing routine governmental actions under duress.

Section 136 abolishes import tariffs through Treasury order within three months. Zero rates apply regardless of origin, classification, or value, with limited exceptions for excise duties, VAT, and public health measures.

Section 137 restores non-domiciled tax status by repealing Finance Act 2025 restrictions. Individuals resident but not domiciled may elect remittance basis taxation for foreign income and gains.

Section 138 designates Special Economic Zones in Northern Ireland, Wales, Crown Dependencies, and the Isle of Wight. Designated areas benefit from five per cent corporation tax, ten per cent income tax, no capital gains tax, no VAT on internal consumption, no employer National Insurance, and additional reliefs by order.

Section 139 creates Free Economic Zones on private land exceeding ten hectares. Owners may develop without planning permission subject to building safety and environmental safeguards.

Section 140 establishes experimental city-charters exempting areas from specified legislation. Orders may create alternative governance, regulatory approaches, tax incentives, and delegated functions.

Section 141 provides fast-track permissions for technology infrastructure including campuses, ports, data centres, and telecommunications.

Section 142 creates United Kingdom Investment Passports for verified individuals and firms. Holders may invest without regulatory approval, acquire securities on institutional terms, and access property investment.

Section 143 establishes fast-track Business and Property Courts procedures for commercial disputes. Requirements include limited pleadings and disclosure, concentrated hearings, and judgment within twenty-eight days.

Section 144 creates an Investor Dispute Resolution Tribunal for expedited claims regarding misrepresentation, contract breach, regulatory failure, or prejudicial changes to existing investments.

Section 145 bars compensation claims arising from climate legislation repeal, green subsidy abolition, contract terminations, or regulatory changes, except for compulsory acquisition, express contractual breach, or discriminatory treatment.

Section 146 prevents damages under European Convention on Human Rights Article 1 Protocol 1 for legislation, subordinate legislation, subsidy withdrawal, regulatory abolition, or economic policy exercises applying generally without discrimination.

Section 147 protects against investor-state dispute settlement claims for general regulatory measures not discriminating between domestic and foreign investors.

PART IX —LAND & DEVELOPMENT

Section 148 repeals all principal planning enactments from the Town and Country Planning Act 1990 to the Levelling-up and Regeneration Act 2023 together with subordinate legislation.

Section 149 abolishes nutrient neutrality requirements and prohibits public bodies from advising, requiring, imposing conditions, objecting, or refusing applications on such grounds.

Section 150 voids extant planning permissions, conditions, and planning obligations twelve months after commencement whilst section 106 agreements discharge entirely.

Section 151 restores absolute property rights and declares 1947 development rights nationalisation contrary to natural justice.

Section 152 establishes Castle Doctrine permitting reasonable force including deadly force against unlawful entrants where necessary to prevent death, serious harm, or forcible offences. No duty to retreat exists and presumptions favour lawful occupiers.

Section 153 vests exclusive territorial sea fishing rights in British citizens with extension possible to exclusive economic zone by regulations.

Section 154 abolishes directly elected mayors of local authorities, combined authorities, and London. Functions transfer to councils.

Section 155 limits councillor numbers to specified maxima ranging from seven for parish councils to forty for county councils and unitary authorities.

Section 156 abolishes the Greater London Authority within six months with functions allocated between new statutory corporations for transport, reconstituted police and fire authorities, and London boroughs.

Section 157 permits local authorities to transfer public libraries to community interest companies established for library operation.

Section 158 abolishes Police and Crime Commissioners with functions transferring to reconstituted police authorities.

Section 159 transfers speed limit setting powers from local authorities to the government.

Section 160 requires local authorities to discharge waste collection, street cleaning, highway maintenance, and parking enforcement exclusively through contracts with private providers.

Section 161 abolishes local authority homelessness duties under Housing Act 1996 Part VII from a date appointed by order.

PART X – ENERGY

Section 162 repeals the Climate Change Act 2008 entirely including carbon budgets, 2050 net zero targets, progress reports, and adaptation programmes.

Section 163 abolishes green subsidy schemes including Renewables Obligation, Feed-in Tariffs, Contracts for Difference, Renewable Heat Incentive, and all grants for renewable energy or energy efficiency.

Section 164 lifts the hydraulic fracturing moratorium and repeals associated prohibitions.

Section 165 abolishes the supplementary charge, Energy Profits Levy, and petroleum revenue tax on North Sea extraction whilst reducing ring fence corporation tax to ten per cent.

Section 166 removes nuclear site licence requirements for small modular reactors under 300 megawatts, micro-reactors under 10 megawatts, and fusion reactors.

Section 167 directs the government to achieve fifty gigawatts nuclear capacity through site designation without consultation, streamlined development consent, financial support, and priority grid connections.

PART XI – PUBLIC SERVICES

Section 168 establishes multiple competing national health service providers within six months.

Section 169 permits persons under forty to exempt themselves from health service National Insurance contributions for up to ten years provided they maintain alternative insurance.

Section 170 requires Personal Health Savings Accounts credited with five to ten per cent of earnings liable to National Insurance.

Section 171 abolishes the cap on medical school training places currently set at seven thousand five hundred annually.

Section 172 requires bodies commissioning health services to consider public, private, and third sector providers equally whilst Clinical Commissioning Groups dissolve.

Section 173 prohibits courts from preventing patients or guardians from leaving the United Kingdom for treatment, obtaining experimental treatment abroad, or discontinuing domestic treatment.

Section 174 entitles NHS patients to redirect treatment value to private providers of their choice.

Section 175 repeals the prohibition on establishing new grammar schools contained in School Standards and Framework Act 1998 section 104.

Section 176 requires conversion of all local authority maintained schools to independent foundations within twenty-four months.

Section 177 permits parents to redirect per-pupil funding between six and seven thousand pounds annually to educational providers of their choice.

Section 178 prohibits instruction promoting political ideologies as fact, contested social theories as science, discrimination on grounds of race, sex, or religion, or rejection of British democracy,

Section 179 removes National Curriculum obligations whilst requiring schools to provide instruction in English, mathematics, sciences, and preparation for adult life.

Section 180 establishes an inspectorate for faith-based schools with powers to enter premises, examine materials, observe teaching, and require document production.

Section 181 requires review of higher education institutions receiving public funding within twelve months.

Section 182 subjects universities receiving public funds to Boards of Public Governors with power to review expenditure over one hundred thousand pounds, prohibit political campaigning, require transparency, and ensure freedom of speech.

Section 183 entitles persons completing two years national service in His Majesty's Armed Forces to state-paid tuition fees up to twenty thousand pounds annually for four years.

Section 184 dissolves the British Broadcasting Corporation within twenty-four months with assets transferred to companies sold by public offering whilst the BBC World Service reconstitutes as a Community Interest Company. Television licence fee abolishes.

Section 185 requires sale of Channel Four Television Corporation and Sianel Pedwar Cymru within eighteen months.

Section 186 requires Ofcom to auction the available broadcasting spectrum within six months.

Section 187 abolishes annual MOT test requirements and replaces it with a reporting system for dangerous vehicles. Vehicle excise duty abolishes.

Section 188 abolishes taxi and private hire vehicle licensing requirements under the Town Police Clauses Act 1847 and Local Government (Miscellaneous Provisions) Act 1976.

PART XII – LIBERTIES & SURVEILLANCE

Section 188 absolutely prohibits public authorities from installing, operating, or maintaining surveillance apparatus in public places.

Section 189 prohibits Ultra Low Emission Zones, Clean Air Zones, congestion charges, and similar schemes restricting or charging vehicle access based on emissions standards.

Section 190 prohibits public authorities from collecting, storing, or processing biometric data except fingerprints and DNA from arrested persons subject to destruction within seven days of non-prosecution, acquittal, discontinuance, or caution expiry.

Section 191 prohibits automatic number plate recognition except for warranted specific vehicle detection or toll collection with immediate deletion post-transaction.

Section 192 absolutely prohibits facial recognition technology by public authorities in all circumstances whether real-time or on stored images.

Section 193 limits the Security Service, Secret Intelligence Service, and Government Communications Headquarters to warranted surveillance under Section 195. Bulk interception, mass surveillance, indiscriminate monitoring, bulk data collection, and receipt of foreign intelligence from mass surveillance programmes are prohibited.

Section 194 grants absolute immunity from prosecution, disciplinary action, or civil proceedings for disclosing unlawful surveillance, breaches of this Part, circumvention attempts, prohibited capabilities, retained prohibited systems, or instructions to contravene.

Section 195 permits surveillance only pursuant to High Court warrants issued where probable cause exists for serious offences punishable by five years or more imprisonment. Warrants must specify named persons or identified premises, last thirty days maximum, and exclude legal professional privilege, political/religious/philosophical surveillance, bulk interception, compelling disclosure of encryption, and unnecessary interference.

Section 196 prohibits identity card schemes.

Section 197 prohibits digital identity systems.

Section 198 makes unlawful financial institution refusal, termination, or restriction of banking services by reason of lawful political opinions, activities, expression, or lawful occupation.

Section 199 prohibits requiring disclosure of medical status, health status, vaccination status, or medical history as condition for employment, education, travel, premises entry, or service access.

Section 200 prohibits social credit systems assigning scores, ratings, or classifications based on behaviour, opinions, or compliance which restrict or grant access to services.

Section 201 prohibits public authorities from requiring Environmental, Social, and Governance criteria compliance.

Section 202 prohibits the Bank of England from issuing central bank digital currency or digital legal tender under direct public authority control.

Section 203 prohibits lockdowns restricting movement, assembly, or normal activity except during an declared emergency. Even during approved emergency, leaving home, travelling, operating businesses, attending worship, and peaceful protest cannot be prohibited.

Section 204 repeals the Investigatory Powers Act 2016, Regulation of Investigatory Powers Act 2000, Data Retention and Investigatory Powers Act 2014, and related surveillance legislation. Intelligence Services Act 1994 and Security Service Act 1989 repeal except oversight and accountability provisions.

Section 205 creates offences carrying up to ten years imprisonment for conducting, authorising, or participating in unlawful surveillance, maintaining prohibited systems, or circumventing prohibitions. Ministers or senior officials authorising breaches face up to fifteen years imprisonment.

Section 206 permits civil proceedings by surveillance victims claiming minimum five thousand pounds per breach regardless of proved loss plus exemplary damages up to one hundred thousand pounds.

Section 207 requires immediate cessation of non-compliant surveillance operations, destruction of prohibited databases within specified time limits verified by independent auditor, and contract voidability for incompatible surveillance services.

PART XIII – FOREIGN RELATIONS

Section 208 grants Parliament or His Majesty by Order in Council power to withdraw from any international treaty, convention, protocol, or agreement.

Section 209 requires immediate withdrawal from treaties listed in Schedule C effective upon commencement.

Sections 210 to 213 amend the Northern Ireland Act 1998, Scotland Act 1998, and Government of Wales Act 2006 removing ECHR references and obligations.

Section 214 declares the EU Withdrawal Agreement, Ireland/Northern Ireland Protocol, and Windsor Framework without force or effect.

Section 215 revokes the India-UK Free Trade Agreement and related memoranda. Ministers cannot enter trade agreements providing unrestricted movement, compromising labour protections, or permitting foreign adjudication.

Section 216 removes international court jurisdiction over United Kingdom law matters save express Parliamentary consent.

Section 217 directs government to seek mutual defence agreements with the United States, Canada, Australia, and New Zealand.

Section 218 prohibits receiving foreign donations, loans, or financial support for political campaigning, influencing public opinion, or supporting causes relating to United Kingdom governance.

Section 219 permits closing institutions funded or controlled by foreign governments, promoting foreign state interests, or engaging in activities contrary to United Kingdom interests. Powers extend to Confucius Institutes and institutions promoting foreign political ideology.

Section 220 limits non-Christian religious worship buildings to four per local authority area.

Section 221 prohibits establishing or operating legal systems other than United Kingdom law including Sharia courts, Beth Din beyond religious status matters, and other religious or customary tribunals.

Section 222 establishes a National Enquiry into Systematic Sexual Exploitation with unlimited powers to investigate organised exploitation patterns, systematic official failures, intimidation of victims, cultural facilitation, and corruption preventing investigation.

Section 223 prohibits foreign persons holding beneficial interests exceeding forty-nine per cent in critical infrastructure including electricity, gas, water, telecommunications, ports, airports, nuclear facilities, and defence manufacturing.

Section 224 declares sovereignty transfer agreements void unless approved by Act. The October 2024 British Indian Ocean Territory agreement is void whilst government must maintain sovereignty over all British Overseas Territories.

Section 225 prohibits agreements permitting Spanish officials any Gibraltar frontier function.

PART XIV – CIVIL SOCIETY

Section 228 prohibits charities from influencing policy or legislation, funding political parties or campaigns, organising demonstrations, publishing advocacy materials, conducting advocacy research, making representations to authorities, or funding other organisations for prohibited purposes.

Section 229 amends the Charities Act 2011 restricting charitable purposes to poverty relief, sickness relief, education advancement, religion advancement, animal rescue, and recreation facilities for social welfare. Purposes explicitly excluded include rights advancement, advocacy, equality promotion, conflict resolution, legal support except ancillary, social research except ancillary, and community development except specified purposes.

Section 230 prohibits charities transferring assets or making payments for reparations, restorative initiatives, decolonisation activities, memorial removal or reinterpretation, programmes addressing systemic discrimination, or purposes depicting United Kingdom institutions as fundamentally unjust.

Section 231 prohibits the Church of England, Church in Wales, Church of Scotland, and legally established religious bodies using property or funds for reparations, decolonisation, or reassessment purposes.

Section 232 prohibits removing, relocating, materially altering, adding interpretive material to, or obscuring monuments erected before 2020 on public land on grounds of contemporary reassessment.

Section 233 repeals the Alcoholic Liquor Duties Act 1979 and Tobacco Products Duty Act 1979. No duty, tax, or levy may impose on alcoholic beverages, tobacco products, or vaping products.

Section 234 declares 23rd April (St George's Day) and 21st October (Trafalgar Day) public holidays in England, 25th January (Burns Night) in Scotland, and 1st March (St David's Day) in Wales.

Section 235 abolishes music performance licensing requirements.

Section 236 permits public house proprietors to determine operating hours between midday and three o'clock morning.

Section 237 transfers alcohol licensing functions from licensing authorities to magistrates' courts.

Section 238 repeals the Tobacco and Vapes Act 2024 provisions.

Section 239 permits persons aged eighteen or over to cultivate up to ten specimens of specified psychoactive plants and fungi for personal use. Cultivation must remain invisible from public places, avoid industrial equipment, exclude under-eighteens from premises, and prevent chemical extraction.

Section 240 creates offences for selling, supplying, distributing, possessing extraction equipment, using prohibited cultivation equipment, supplying under-eighteens, or cultivating in premises accessible to under-eighteens.

Section 241 exempts licensed activities under Misuse of Drugs Act 1971, scientific research, education, pharmaceutical development, laboratory equipment for unrelated purposes, and medical practitioner therapeutic treatment from sections 239 and 240.

Section 242 restricts flags on public authority buildings.

Section 243 prohibits painting, illuminating, or decorating public authority property with colours, symbols, or designs associated with political movements except constitutional significance matters.

Section 244 prohibits requiring or accepting rental deposits for residential tenancies entered after commencement. Landlords may require tenant insurance.

Section 245 establishes escrow arrangements for disputed end-of-tenancy claims held by solicitors, licensed conveyancers, or authorised persons.

Section 246 abolishes specified licences and permits in Schedule B.

PART XV – BOE & MONETARY POLICY

Section 247 requires the Bank of England to cease interest payments on reserve balances deriving from quantitative easing operations.

Section 248 repeals foreign aid: no public funds may be committed or expended for official development assistance.

Section 249 amends the Bank of England Act 1998 requiring House of Commons approval before Treasury gives indemnities for asset purchase losses.

Section 250 vests decisions regarding sale, disposal, or reduction of quantitative easing assets exclusively in the Treasury.

Section 251 repeals the Bank of England Act 1998 section 1A and amends Schedule 1 permitting Chancellor to remove the Governor, Deputy Governors, or committee members at any time by recommendation to His Majesty or notice without stating reasons.

Section 252 establishes Bank of England accountability to the Treasury for all functions save determining the official Bank Rate.

A Revolutionary Constitutional Settlement

This draft legislation proposes the most comprehensive restructuring of British governance since the constitutional reforms of the early twentieth century. The Bill systematically dismantles the regulatory and institutional framework built up over the past seventy years, replacing it with a radically different vision of state authority and individual freedom.

This approach reverses the gradual accumulation of licensing regimes, regulatory approvals, and administrative oversight developed since 1945. Where current law often requires citizens and businesses to seek authorisation before acting, this Bill abolishes hundreds of such requirements outright.

Parliamentary sovereignty receives explicit codification in absolute terms, with courts instructed to interpret statutes according to their plain meaning whilst rejecting purposive construction, international law references, and most grounds of judicial review. Recent Supreme Court decisions limiting executive power face explicit reversal.

The judiciary undergoes fundamental restructuring: the Supreme Court disappears, replaced by a Final Appeal Court with reduced jurisdiction; the Lord Chancellor regains personal power to appoint and dismiss judges; and judicial candidates for senior positions must endure sixty days of public scrutiny regarding their philosophy, associations, and potential conflicts of interest. Judges become removable for "judicial activism," defined to include developing common law where Parliament has legislated, creating new causes of action, or deciding cases based on international instruments not incorporated into domestic law.

Britain withdraws from the European Convention on Human Rights, the Refugee Convention, and dozens of other treaties. Courts lose authority to interpret domestic law by reference to international obligations unless Parliament explicitly requires such consideration.

The Bill amends devolution settlements to remove ECHR incorporation as a constraint on devolved legislatures. Customary international law ceases to form part of British law. The Crown regains unfettered treaty-making and treaty-breaking powers without parliamentary approval.

Statutory protections for civil service independence vanish entirely. Ministers acquire power to dismiss senior officials—including Permanent Secretaries—without cause, compensation, or appeal. Civil servants owe complete obedience to ministerial direction, with refusal constituting gross misconduct punishable by immediate dismissal and pension forfeiture. The Civil Service Commission disappears.

Ministers may recruit by any method they choose, disregarding merit principles, and may reserve positions for persons sharing their political sympathies.

Parliament itself faces dramatic changes. New members must pass an entrance examination testing knowledge of British history, constitutional law, legislative interpretation, formal logic, and English language proficiency. The exam covers everything from the Norman Conquest through modern devolution settlements, requiring candidates to demonstrate ability to read complex statutes, construct valid arguments, and identify logical fallacies.

Postal voting ends except for armed forces personnel, the severely disabled, and prisoners awaiting trial. No person qualifies for public office without being born in Britain or a British territory, residing in Britain for fifteen years, and swearing a specific oath pledging allegiance to the Crown and the established Church. Foreign funding of political activities becomes criminal.

Electoral spending limits disappear. The Electoral Commission vanishes. Political parties need not register with any authority. Any person or organisation may spend unlimited sums supporting or opposing candidates, provided funds derive from lawful sources and the spender is entitled to vote in British elections.

Members of Parliament face stringent attendance requirements: falling below forty percent attendance triggers automatic loss of seat. Members must maintain constituency offices open three days weekly during sitting periods and five days during recess. Ministers who fail to answer parliamentary questions within prescribed timeframes commit contempt of Parliament.

The Bill revives parliamentary impeachment for ministers, civil servants, judges, police chiefs, and heads of public bodies, with conviction requiring two-thirds majorities but permitting removal from office, disqualification, and pension forfeiture.

Fiscal discipline receives constitutional entrenchment. National debt may not exceed sixty percent of GDP. Budget deficits require war, declared emergency, or two-thirds parliamentary approval. The prohibition extends to monetary financing: the Bank of England may not purchase government securities directly from the Treasury, create money to finance government spending, or engage in quantitative easing. Violations bring criminal liability including seven years' imprisonment for Bank officials. Interest payments on existing quantitative easing reserves cease immediately. The Bank loses operational independence over asset sales, with such decisions reverting to the Treasury. The Governor, Deputy Governors, and committee members become removable at will by the Chancellor without cause or process.

Foreign aid vanishes entirely. The International Development Acts of 2002, 2014, and 2015 face repeal. No minister may commit public funds to official development assistance as defined by OECD rules. Existing commitments become void. Departments must terminate all such programmes within ninety days.

The tax system undergoes wholesale reconstruction. Income tax becomes a flat ten percent on earnings above a £50,000 personal allowance. Capital gains and dividends face taxation at fifteen percent above £1,000,000 annual exemptions. Assets held over two years become exempt from capital gains tax. Corporation tax falls to five percent.

National Insurance contributions end for employees; employers pay a flat 7.5 percent levy. Value Added Tax disappears, replaced by optional local sales taxes up to fifteen percent. Inheritance tax, stamp duty, climate levies, fuel duties, alcohol and tobacco duties, vehicle excise duty, and dozens of other imposts listed in Schedule A cease entirely. The tax code must fit within fifty pages.

The Bill repeals speech offences wholesale—the Communications Act section 127, the Malicious Communications Act, public order provisions regarding threatening or abusive speech, and hate speech legislation. Criminal liability for speech survives only for direct threats to kill, explicit incitement to imminent violence, or knowingly false statements made with actual malice.

Public order law narrows dramatically to riot, violent disorder, and affray—all requiring actual violence or its immediate threat. Police lose power to impose conditions on assemblies or processions except where credible intelligence indicates imminent riot.

Anti-social behaviour orders, injunctions, criminal behaviour orders, community protection notices, public spaces protection orders, dispersal orders, and similar civil restrictions disappear entirely. Police may not record non-crime hate incidents. Courts may not impose civil orders criminalising lawful conduct.

Equality Act provisions face complete repeal, ending protected characteristics, positive duties to prevent discrimination, and enforcement mechanisms. The Online Safety Act vanishes.

No public authority may install or operate CCTV cameras, automatic number plate recognition, facial recognition, or any surveillance apparatus in public places. Existing systems must be disabled within seven days and physically removed within ninety. Ultra Low Emission Zones and congestion charges end. All biometric databases except those for convicted serious offenders face destruction within thirty days.

The Investigatory Powers Act, Regulation of Investigatory Powers Act, and associated legislation undergo repeal. Intelligence agencies lose authority to conduct mass surveillance or bulk interception. They may only target specific individuals pursuant to judicial warrants.

Identity cards become illegal. No mandatory digital identity system may be established. Banks may not refuse services based on lawful political opinions or activities. Health passports and vaccine mandates face prohibition except during declared emergencies with ninety-day parliamentary renewals. Social credit systems and ESG scoring of individuals become criminal offences. Central bank digital currencies receive statutory prohibition. Cash acceptance becomes mandatory for transactions under £10,000.

Planning law disappears. The Town and Country Planning Acts 1990, the Planning (Listed Buildings and Conservation Areas) Act 1990, the Planning Act 2008, and numerous successor enactments face complete repeal. Development rights revert to landowners.

No permission is required for any building, change of use, or development. Nutrient neutrality requirements end. The principle applies that owners may do anything with their land not expressly prohibited by statute, subject only to nuisance law, easements, restrictive covenants, and statutory protections for scheduled monuments.

Immigration undergoes a five-year moratorium. No person lacking British citizenship may receive leave to enter or remain except spouses and children of British citizens meeting residence requirements, brief transit passengers, witnesses in legal proceedings, and cases of "overwhelming compassion in wholly exceptional circumstances"—defined to require urgent life-saving medical treatment unavailable elsewhere and provided at no public cost.

Asylum becomes available only for direct arrivals with identity documents who claim protection immediately upon entry, fleeing systematic state programmes of genocide or enslavement. Safe third country transit bars all claims.

Maritime interception and turnback operations receive explicit authorisation. Britain withdraws from the Refugee Convention pending renegotiation.

Employment regulation undergoes systematic decommissioning. Small businesses employing fewer than fifty persons become exempt from unfair dismissal laws, redundancy payment requirements, and most employment protection legislation. IR35 off-payroll working rules vanish.

Employers and employees may agree to at-will employment contracts permitting termination by either party without cause, notice, or liability, subject to protections against discrimination on grounds of pregnancy, protected disclosures, health and safety activities, and trade union membership. Minimum wage laws face abolition. Maximum wage prohibitions likewise become illegal.

Licensing requirements across hundreds of activities disappear. Schedule B lists several hundred abolished licenses and permits spanning food premises approvals, entertainment licenses, street trading permits, vehicle operator licenses, professional registrations, and recreational permissions.

The Health and Safety at Work Act 1974 undergoes repeal. Environmental permitting regimes vanish. Energy sector licensing ends. Companies may generate, transmit, and supply electricity and gas without authorization. Nuclear reactor licensing for small modular reactors, micro-reactors, and fusion reactors gives way to simplified notification and safety standards.

Climate change legislation receives comprehensive abolition. The Climate Change Act 2008 disappears along with carbon budgets, net zero targets, and the Committee on Climate Change. Green subsidies terminate immediately, including the Renewables Obligation, feed-in tariffs, Contracts for Difference, the Renewable Heat Incentive, and the Boiler Upgrade Scheme. Existing contractual commitments end forthwith. Compensation becomes available but may not exceed actual capital expenditure or fifty percent of projected future payments, whichever proves less.

The moratorium on hydraulic fracturing lifts. North Sea taxation falls dramatically: petroleum revenue tax ends, the supplementary charge vanishes, the Energy Profits Levy terminates, and ring-fence corporation tax drops to ten percent. Oil and gas licenses receive priority treatment. Nuclear deployment targets call for fifty gigawatts of capacity through streamlined procedures, financial support, priority grid connections, and removal of regulatory obstacles.

Multiple national health service providers may operate. Persons under forty may opt out of National Insurance health contributions for up to ten years if they maintain alternative insurance. Personal Health Savings Accounts receive credits of five to ten percent of earnings for medical expenses. Medical school place caps disappear. Private providers compete equally for NHS commissioning. Patients may redirect NHS funding to private providers of their choice.

Grammar schools return. Schools convert from local authority control to independent foundations within twenty-four months. Parents may redirect per-pupil funding to any registered educational provider including independent schools, home education programmes, and online platforms. No school must follow the National Curriculum. Faith schools receive enhanced inspection for extremism. Universities offering courses with graduate employment below fifty percent or operating primarily commercially risk losing degree-awarding powers and public funding.

The BBC faces privatisation within twenty-four months, sold by public offering or private sale. Channel Four and S4C likewise face sale or dissolution. The television license fee ends.

Broadcasting spectrum undergoes auction. Community radio stations may broadcast on available frequencies without license upon paying nominal registration fees.

Directly elected mayors—including the Mayor of London—lose their offices immediately. Functions transfer to councils or, in London's case, to borough joint arrangements or new statutory corporations for transport and emergency services. Councillor numbers face statutory limits: thirty for London boroughs and metropolitan districts, twenty for non-metropolitan districts, forty for counties and unitary authorities, seven for parish councils.

Police and Crime Commissioners disappear, replaced by reconstituted police authorities with mixed appointed membership.

Public libraries may transfer to community interest companies. Speed limits become solely matters for the Secretary of State. Local authorities lose all licensing functions for alcohol sales, which transfer to magistrates' courts.

Taxi and private hire licensing disappears entirely. Local authorities must competitively tender refuse collection, street cleaning, highway maintenance, parks maintenance, parking enforcement, and public conveniences to private providers.

The rental market sees deposits prohibited, replaced by mandatory insurance covering damage, arrears, and cleaning costs up to specified limits. Landlords may specify up to three insurers; tenants may choose any provider meeting policy requirements. Premiums may not exceed eight percent of annual rent for the least expensive option.

Trade liberalisation proceeds through abolition of all import tariffs. Businesses may establish without licenses across hundreds of previously regulated activities. Companies may be single-member limited liability companies with simplified taxation. Programmable legal entities and distributed autonomous organizations receive statutory recognition.

Banks may custody cryptoassets, accept deposits in any currency, and establish branches in Crown Dependencies and British Overseas Territories without restriction. Certain cryptoassets meeting specified criteria gain recognition as private money.

Foreign policy undergoes systematic reorientation. Britain withdraws from dozens of treaties, potentially including foundational UN human rights instruments, climate agreements, ILO conventions, and Council of Europe instruments.

The Withdrawal Agreement with the European Union terminates. No foreign funding of political activities becomes permissible.

Confucius Institutes face closure orders. Religious institutions receiving more than ten percent foreign funding lose tax exemptions. A ceiling limits buildings for non-Christian worship to four per local authority area.

Retained EU law faces systematic revocation. The regulatory framework built since 1945—spanning employment law, environmental regulation, consumer protection, data protection, anti-money laundering rules, product safety requirements, and hundreds of other areas listed in Schedule D—undergoes abolition or radical simplification.

Possession and use of defensive devices including stun guns, pepper spray, and related equipment become legal subject to age and criminal history restrictions. Personal cultivation of specified psychoactive plants and fungi—including cannabis, psilocybin mushrooms, and mescaline-containing cacti—becomes lawful for adults subject to strict quantity limits, visible concealment requirements, equipment restrictions, and absolute prohibitions on distribution, extraction, and child access. Violation of distribution prohibitions brings up to fourteen years imprisonment; supplying to or permitting consumption by minors risks twenty years.

The Bill establishes fast-track courts for commercial disputes, an Investor Dispute Resolution Tribunal for investment claims, and protections against compensation claims arising from policy reversals including net zero abolition, subsidy termination, and regulatory repeal. It prohibits litigation funded by public money on environmental grounds. It strips honours and titles for serious criminality or bringing the honours system into disrepute. It creates a National Enquiry into systematic sexual exploitation with unlimited powers to compel evidence, examine all records, and refer matters for prosecution, publishing findings in full.

Constitutional debt ceilings, balanced budget requirements, and welfare spending limits receive statutory entrenchment. Parliamentary impeachment mechanisms extend to ministers, civil servants, judges, and public officials.

Whistleblower protections cover unlawful surveillance and constitutional violations. Criminal records expungement becomes available for offences under repealed legislation or regulatory infractions listed in Schedule I—ranging from minor traffic violations through licensing breaches to victimless regulatory infractions.

The scope proves breathtaking: simultaneous abolition of the planning system, climate legislation, equality law, surveillance infrastructure, immigration pathways, employment regulation, licensing regimes, criminal speech offences, judicial independence protections, civil service statutory basis, foreign aid commitments, international treaty obligations, public health restrictions, financial regulations, and hundreds of regulatory instruments accumulated over seventy years.

The Bill proposes replacement with constitutional codification of Parliamentary sovereignty, negative liberty principles, fiscal discipline, competitive public service provision, and systematic deregulation across nearly every sphere of economic and social life.

Taxes Wiped Out By NELA

Income and Employment

- Income Tax rates above 10% flat rate (Income Tax Act 2007, section 6)

- Income Tax bands below £50,000 personal allowance (Income Tax Act 2007)

- Pay As You Earn mandatory deduction system (Income Tax (Earnings and Pensions) Act 2003, Parts 2 and 11)

- National Insurance Contributions (Social Security Contributions and Benefits Act 1992) – replaced by 7.5% employer-side flat levy

Capital and Wealth

- Capital Gains Tax rates and bands above £1,000,000 annual exempt amount and above 15% flat rate (Taxation of Chargeable Gains Act 1992)

- Dividend Tax rates and bands above £1,000,000 annual allowance and above 15% flat rate (Income Tax Act 2007)

- Inheritance Tax (Inheritance Tax Act 1984)

- Taxes on accumulated capital, net worth, or total assets held by any person or legal entity

Corporate and Business

- Corporation Tax rates above 5% (Corporation Tax Act 2010, Part 3)

- Ring Fence Corporation Tax on oil and gas at 30% (Income and Corporation Taxes Act 1988, Part 12, Chapter 5)

- Supplementary Charge on oil and gas at 10% (Finance Act 2002, Schedule 25)

- Energy Profits Levy on oil and gas at 38% (Energy (Oil and Gas) Profits Levy Act 2022)

- Bank Levy (Finance Act 2011, Part 1)

- Municipal Financial Transaction Taxes

- Business Rates (Local Government Finance Act 1988, Parts 2 to 5)

Consumption and Sales

- Value Added Tax (Value Added Tax Act 1994) – replaced by local parish sales tax

- Stamp Duty Land Tax and Stamp Duty Reserve Tax (Finance Act 2003, Parts 4 and 5)

- Insurance Premium Tax (Finance Act 1994, Part 3)

- Betting and Gaming Duties (Betting and Gaming Duties Act 1981 and successor provisions)

- Pool Betting Duty (Finance Act 1966, Part 1)

Environmental and Energy

- Aggregates Levy (Finance Act 2001, Part 2)

- Climate Change Levy (Finance Act 2000, Schedule 6)

- Carbon Price Support (Finance Act 2013, sections 78 to 83)

- Landfill Tax (Finance Act 1996, Part 3)

- Plastic Packaging Tax (Finance Act 2021, Part 2)

- Carrier Bag Charge (Climate Change Act 2008, Schedule 6A as inserted by the Environment (Wales) Act 2016)

- Soft Drinks Industry Levy (Finance Act 2017, Part 2)

Transport, Fuel and Vehicles

- Fuel Duties (Hydrocarbon Oil Duties Act 1979 and associated enactments relating to petrol, diesel, gas, biofuels, hydrogen or any other vehicle fuel)

- Heavy Goods Vehicle Road User Levy (HGV Road User Levy Act 2013)

- Petroleum Revenue Tax (Oil Taxation Act 1975)

- Congestion Charges and Ultra Low Emission Zone Charges (Greater London Authority Act 1999, sections 295 to 316 and any scheme or order made thereunder)

- Vehicle Excise Duty (Vehicle Excise and Registration Act 1994 – included here as an annual vehicle tax)

- Air Passenger Duty (Finance Act 1994, sections 28 to 44)

Alcohol, Tobacco and Other Duties

- Alcoholic Liquor Duties (Alcoholic Liquor Duties Act 1979)

- Tobacco Products Duty (Tobacco Products Duty Act 1979)

- Cider and Perry Duty (Alcoholic Liquor Duties Act 1979, sections 62 to 66 – subsumed within alcohol duties but listed separately here)

- Spirits Duty (Alcoholic Liquor Duties Act 1979, sections 5 to 6)

- Beer Duty (Alcoholic Liquor Duties Act 1979, sections 36 to 37)

- Wine Duties (Alcoholic Liquor Duties Act 1979, sections 54 to 56)

Trade, Customs and Imports

- Import Tariffs (Taxation (Cross-border Trade) Act 2018)

- Customs Duties (Customs and Excise Management Act 1979 – general duties on imported goods)

Licensing Wiped Out By NELA

Health & social care – provider, service and manager registrations

- Adoption service manager registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adoption service registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adult care home manager registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adult care home worker registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adult placement manager registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adult placement service registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Adult placement services registration (Health and Social Care Act 2008, Part 1)

- Adult placement services registration Northern Ireland (The Adult Placement Agencies Regulations (Northern Ireland) 2007)

- Adult placement services registration Scotland (Public Services Reform (Scotland) Act 2010, Part 5)

- Advocacy service registration (Regulation and Inspection of Social Care (Wales) Act 2016)

- Care at home services registration Scotland (Public Services Reform (Scotland) Act 2010, Part 5)

- Care home service registration Wales (Regulation and Inspection of Social Care (Wales) Act 2016)

- Day care services registration Northern Ireland (Children (Northern Ireland) Order 1995, Part XI)

- Day care settings registration Northern Ireland (Day Care Settings Regulations (Northern Ireland) 2007)