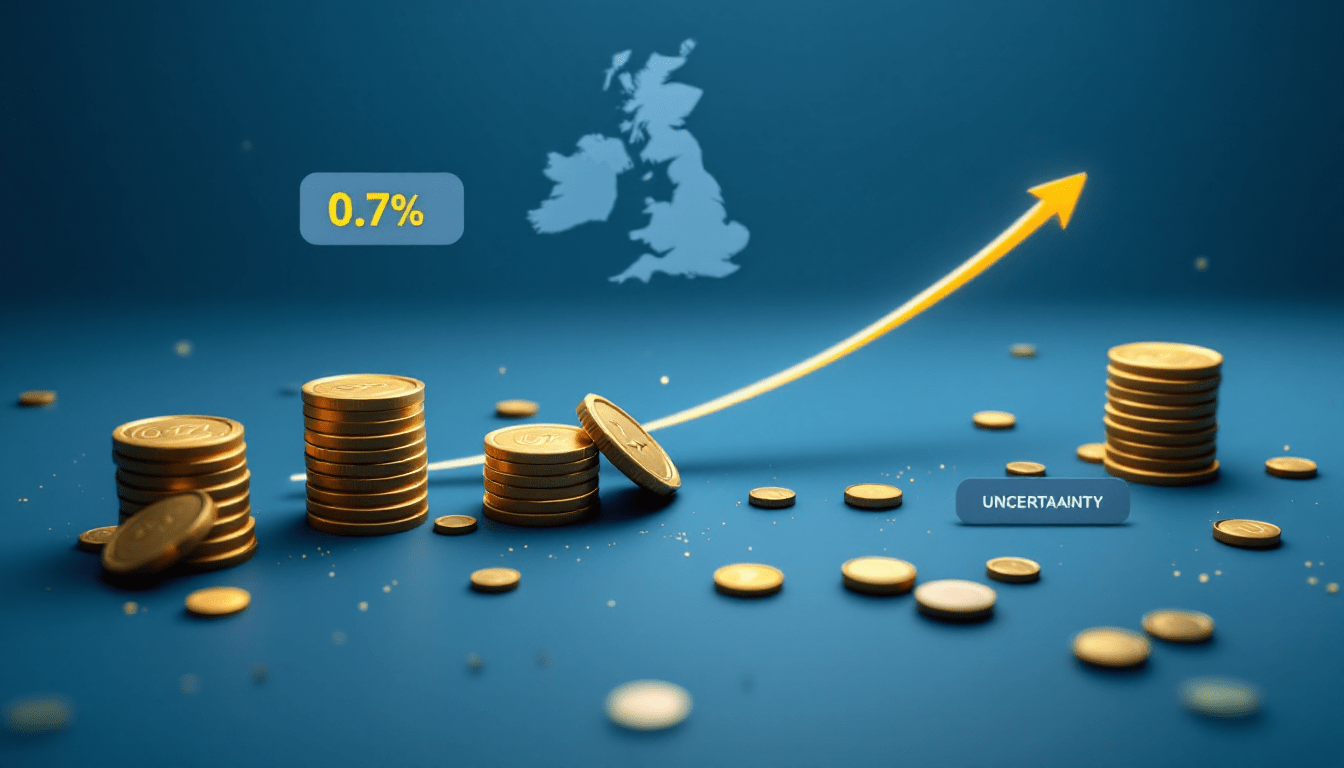

Where We Are: Sluggish Growth and Policy Uncertainty

YooKay growth remains sluggish despite 0.7% Q1 rise. Frozen tax thresholds create fiscal drag while higher employer NICs burden businesses. With SMEs generating 52% of private turnover, better finance access and tax reform could unlock productivity and restore confidence.